is pre k tax deductible

A credit called the Child and Dependent Care Credit worth up to 1050 for one. The IRS does not offer tax breaks for the education expenses incurred for students in kindergarten through high.

Pre Tax Vs Post Tax Deductions What Employers Should Know

Although preschool expenses do not qualify as a tax deduction on their own right you can claim them as part of the child and dependent care credit assuming you qualify.

. That doesnt necessarily mean you cant still get some money. By Katherine Hutt Scott. Tuition is not deductible on federal income taxes but parents have other options to reduce costs.

First and foremost you should know that preschool tuition isnt technically tax deductible. Experience Our Play-Based Program In Action. This lets employees save for retirement and reduce their taxable income.

Although kindergarten tuition isnt tax deductible the expenses for a before- or after-school care program might qualify for the child and dependent care credit. The sum of your childs entire preschool tuition is not tax deductible but you may be able to get something better than a deduction. Additionally you might consider.

Nursery school and other prekindergarten costs generally qualify for the Child and Dependent Care Credit because the educational benefits are considered incidental to the child care costs. Kindergarten costs are generally not eligible for any tax credits or deductions. Ad Over 30 Years Of Experience Nurturing Educating Children.

Im pleased to say that under certain circumstances you can indeed claim a tax benefit for preschool tuition. A credit called the Child. Tour A Daycare Near You.

Summer day camps also count as child care. A credit called the Child and Dependent Care. Is there tax relief for preschool parents.

Is preschool tuition deductible. Small business tax prep File yourself or with a small business certified tax professional. Although kindergarten tuition isnt tax deductible the expenses for a before- or after-school care program might qualify for the child and dependent care credit.

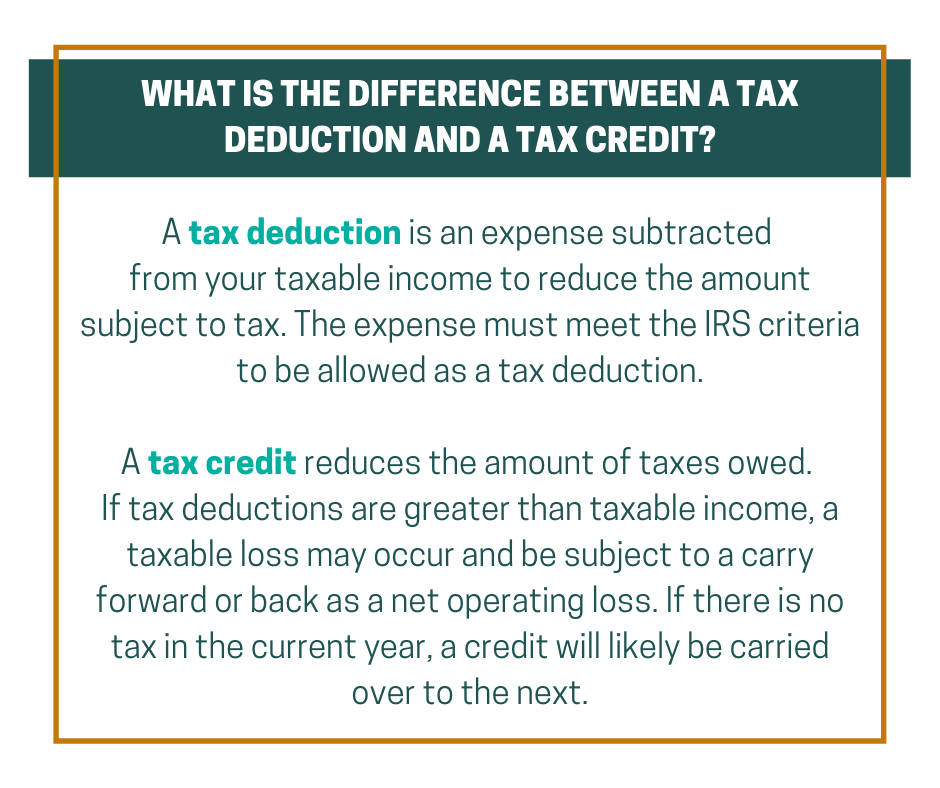

Tax credits also directly reduce your tax. Nursery school preschool and similar pre-kindergarten programs are considered child care by the IRS. Table of Contents show.

Typically preschool expenses were only counted toward a child and dependent care credit and not a education credit or. August 20 2021 by Steve Banner EA MBA. Preschool fees are generally not tax-deductible from a parents taxes.

Find A Program Near You Today. Bookkeeping Let a professional handle your small business books. And thanks to recent.

Is Private School Tuition Tax Deductible. A pre-tax deduction means that an employer is withdrawing money directly from an employees paycheck to cover the cost of benefits before withdrawing money to cover. A deductible expense is the one you can subtract from your income to reduce your tax liability.

The sum of your childs entire preschool tuition is not tax deductible but you may be able to get something better than a deduction. Additionally you might consider. Some retirement plans are eligible for pre-tax deductions such as certain IRAs and 401 k plan types.

.png)

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

6 Common Miscellaneous Expenses Examples Tax Deduction Tips For Small Businesses

Is Life Insurance Tax Deductible

Is Tutoring Tax Deductible Soflo Sat Tutoring

Are Montessori Preschool Expenses Tax Deductible Hill Point Montessori

Fish Theme Preschool Classroom Lesson Plans Preschool Lesson Plans Kids Learning Activities Preschool Lessons

Products Archive The Daycare Providers Tax Survival Manual Daycare Providers Family Day Care Daycare Business Plan

/200131-taxes-deductions-2-2000-8ef0ef5afaac44aaa7c397745a4b41f0.jpg)

Is It Tax Deductible 7 Things Parents Should Know Before They File

Is Preschool Tuition Tax Deductible Motherly

Pre Tax Vs Post Tax Deductions What Employers Should Know

World Flags Nomenclature Cards

Are Closing Costs Tax Deductible Nextadvisor With Time

Can I Get A Student Loan Tax Deduction The Turbotax Blog

Can I Claim Expenses For Preschool As A Tax Deduction

Tax Credits Deductions For Your Transportation Business